How Much Money Do You Really Make?

A Practical Guide to Understanding Your Total Compensation

By: Lianabel Oliver

How much money do you really make? Does your hourly rate or base salary accurately reflect how much you earn? How do the benefits paid by your employer increase the value of your total compensation package?

Your total compensation is your gross pay plus any payroll taxes and fringe benefits the company pays on your behalf. In addition, you must consider the value of paid time off (PTO) in the form of vacation, sick leave, holidays, and personal leave. All other things being equal, a person who receives 15 PTO days makes less money than a person who receives 25. So, how do you calculate the value of your total compensation package? Let us walk you through this calculation with a simple example.

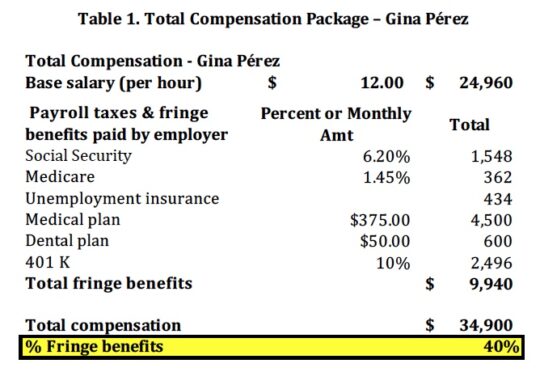

Gina Pérez is a full-time employee of Company XYZ. She earns $12 per hour and is guaranteed 40 hours per week as part of her contract. She contributes 5% of her yearly salary to the company’s retirement plan. Her employer pays for medical and dental insurance and doubles the amount of the employee contribution to the retirement plan up to a maximum of 10%. Table 1 below summarizes her total compensation package.

As you can see from Table 1, Gina’s compensation totals $34,900, of which payroll taxes and fringe benefits represent 40% of her base salary. The value of these benefits increases her base salary significantly, even though this amount is not reflected in her net paycheck.

Why are government-mandated taxes such as Social Security, Medicare, and unemployment taxes considered in this calculation? Government-mandated taxes provide employees with future benefits for which they may be eligible under certain circumstances. Therefore, while you may see little value in these benefits at the moment, these should be considered in your calculations. Note that if you are a resident of the U.S. and opt to be self-employed, you will be required to pay 15.3% of your net earnings for Social Security and Medicare. This percentage represents the portion corresponding to you, and the rest, the portion paid by your employer.

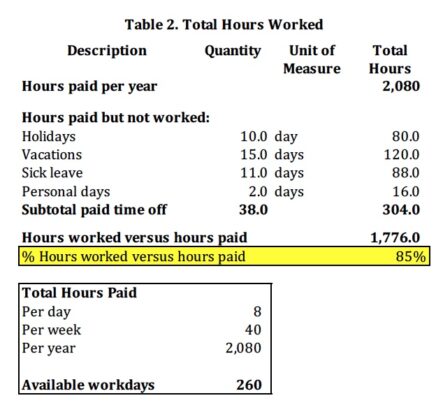

Gina also needs to consider the value of paid time off. Table 2 shows the calculation of the total hours worked versus the total hours paid. Note that Gina receives 38 days of paid time off as follows: 10 holidays, 15 vacation days, 11 days of sick leave, and 2 days of personal time off.

Table 2 shows that Gina works 85% of the hours that she gets paid for. How do we factor in the paid time off in our salary calculations?

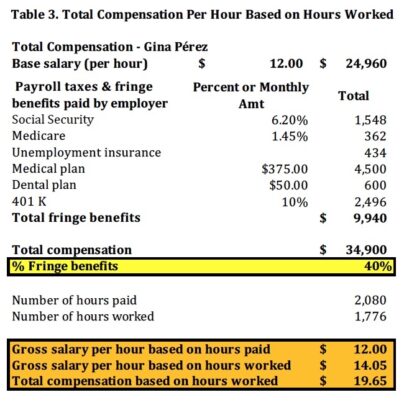

Table 3 shows Gina’s hourly wage based on 2,080 hours, which is $12 per hour, the hourly wage considering payroll taxes, fringe benefits, and paid time off. When you calculate her hourly wage based on total compensation and the number of hours worked, it raises her total compensation to $19.65 per hour, a 64% increase of her base salary!

So why is this calculation important and why should you care? Often, employees focus on the amount of their net paycheck when evaluating promotions or other job opportunities instead of their total compensation package. They may consider leaving a job or working as a subcontractor for a small increase in their hourly rate, without considering the monetary value of employer paid taxes and fringe benefits. This calculation will allow you to better understand how much money you really make and analyze your compensation package in terms of hard dollars. Remember any reduction in paid time off is a decrease in your total compensation and should be factored into any decision.

Contact us at [email protected] to obtain a free spreadsheet that will allow you to easily perform the calculations explained in this article based on your own personal situation. We hope you find it an enlightening experience.